Notice: The trading of this cryptocurrency is currently not supported on OKX. Continue trading with cryptocurrencies listed on OKX.

YZY

YZY price

This data isn’t available yet

You’re a little early to the party. Check out other crypto for now.

YZY Feed

The following content is sourced from .

In-depth analysis of the Fair3 Foundation mechanism: How does the first "decentralized insurance" in the cryptocurrency industry form a buying flywheel?

Article source: Fair3

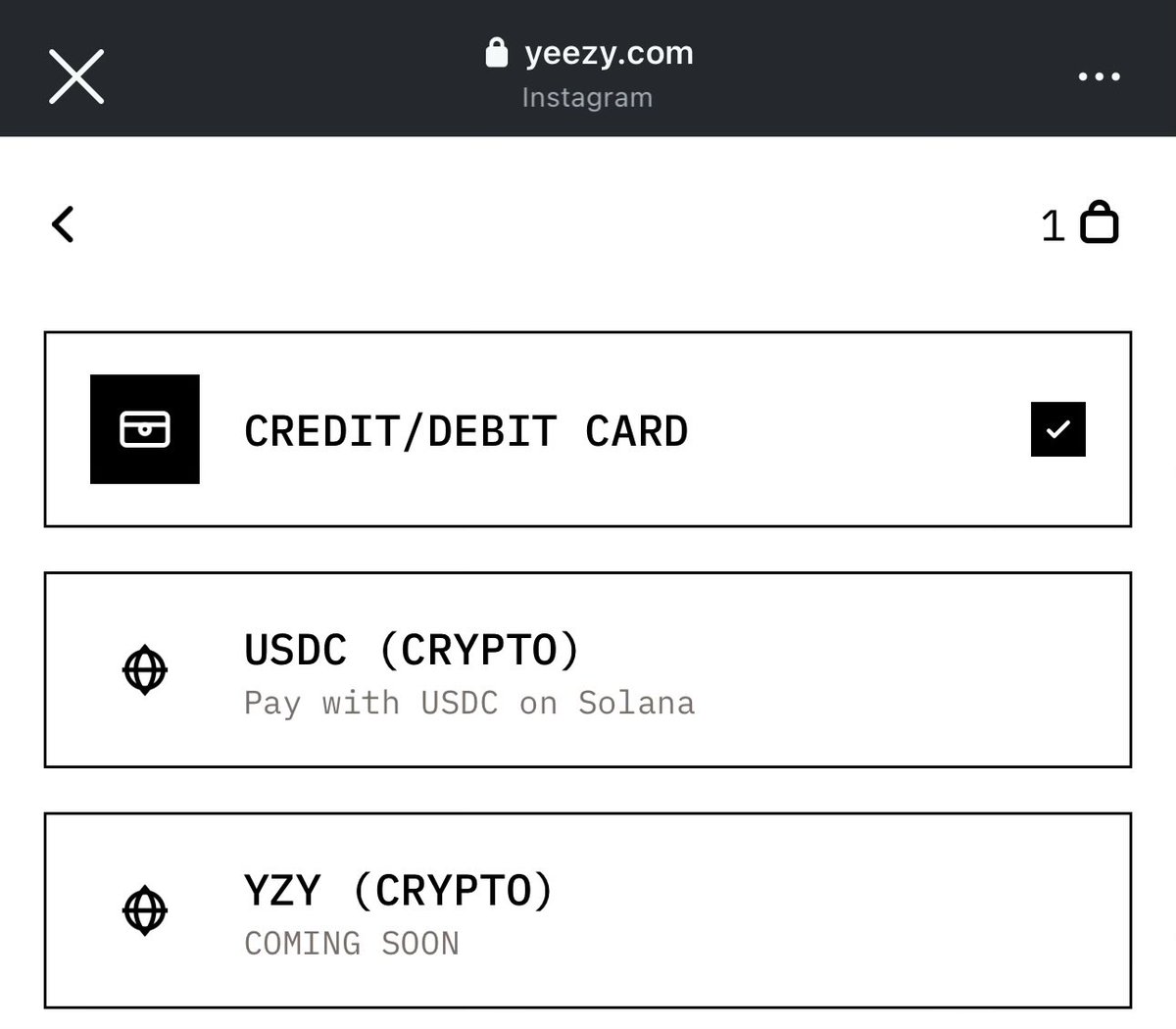

In the world of the crypto industry, scams are not new. But in the past two years, the speed of "running away", the clever method, and the large number of victims have still refreshed the public's perception of the word "Rug Pull". From the VC-backed project Movement, to the meme coin $YZY supported by celebrity Kanye West, to the Solana project AQUA, which has recently quietly disappeared, investors' funds have flowed away like an open faucet, leaving behind a sense of chicken feathers and powerlessness.

According to RootData data, there have been more than 260 Rug incidents in the Web3 market since 2024, involving more than $500 million. More importantly, most of these victims do not have any form of protection mechanism. Blockchain emphasizes "code is law", but once it involves scenarios such as abandonment by the project party, cancellation of social media accounts, and non-open source of smart contracts, ordinary users are almost impossible to hold accountable.

In traditional financial markets, risk hedging mechanisms are layered fortified, and Web3, although it boasts of "decentralized autonomy," often lacks systematic countermeasures when risks truly arise. The response after a project collapse is usually only a short-term community reassurance and aftermath compensation, rather than a solution that can be replicated and institutionalized.

It is in this context that a new attempt is attracting the attention of the community: the Fair3 Fairness Foundation. This is an on-chain insurance system that does not rely on project parties or exchanges, but is entirely spontaneously established by the community, and it is trying to answer a long-ignored question: "What can we do when the risk really comes?"

This mechanism is not only a "decentralized insurance" but may also become a new buying driver, changing the logic of cryptocurrency token economics.

Decentralized insurance practice after the AQUA event

In September 2025, a piece of news quickly spread in the Solana Chinese community: the AQUA project was missing. The project was once hailed as a "representative of the potential environmental protection track" on Solana, but only three weeks after its launch on the exchange, the team collectively lost contact, the community disbanded, and the token returned to zero overnight.

Unexpectedly, without any compensation from the project party, the Fair3 Foundation became the first third party to stand up and provide insurance for community users.

According to the official announcement, Fair3 has launched an insurance plan totaling 100,000 FAIR3s. The insurance plan not only requires users to provide screenshots of their on-chain holdings, but also introduces a dual-track structure of "main compensation pool + public pool", and gives different compensation amounts depending on whether users hold and stake FAIR3. All processes are carried out transparently on-chain, and the source of insurance funds comes from the foundation's previously fixed quarterly reserves.

The actual operation of this mechanism has become a rare case of "non-project leadership" compensation in the crypto world. It not only brought about a short-term reversal of public opinion, but also aroused new thinking in the industry about "whether the public security mechanism can be on-chain".

The core logic of the foundation: insurance, but decentralization

At the heart of the Foundation's design is to compensate users who have been wronged. It requires victims to not only hold both Fair3 and the victim's tokens at the time of the incident, but also stake Fair3 to be eligible for compensation. The compensation amount is determined by the user's staking ratio and can account for up to 10% of the compensation pool. At the same time, staking more Fair3 not only means a higher protection limit, but also gains governance rights: more than 5,000 can be voted on, and more than 100,000 can even make compensation proposals. In other words, the process of staking Fair3 is essentially equivalent to buying an insurance policy, which also gives users the power to influence the payout outcome.

Traditionally, insurance is provided by centralized companies, with users paying premiums and companies paying in the event of an accident. The Fair3 Foundation essentially moved this model on-chain and made three key changes:

On-chain transparency: Compensation qualifications are verified by snapshots to avoid post-coverage fraud.

Position linkage: The compensation amount and voting rights are directly tied to the amount of $FAIR3 staked.

Community governance: Whether an event is recognized as a "compensation case" is determined by the vote of the coin holder.

The result is: buying $FAIR3 and staking is not only buying coins, but more like buying an "on-chain insurance policy".

Why is it not just insurance?

If it's just insurance, the Fair3 Foundation can be considered a "stop-loss tool for users" at most. What is truly unique is that this mechanism is naturally bound to the logic of buying.

Holding is Guaranteed: Users must stake $FAIR3 to be eligible for compensation.

The more you hold, the higher the protection: large pledges not only increase the amount of compensation, but also obtain the right to propose.

Governance binding: 5,000 $FAIR3 can be voted, and more than 100,000 tokens can be used to initiate proposals.

In other words, if you want to be protected and have a say, you must buy and stake $FAIR3 for a long time.

How do insurance and buying form a flywheel?

The real power of this mechanism is that it naturally builds a "buy flywheel":

Users buy and stake Fair3 – get an insurance policy that won't lose their money due to a rug event.

Users participate in governance - more people can decide which events go into the paylist.

Users receive compensation - In the event of a black swan, the foundation compensation pool is distributed according to the proportion of staking.

Users add buy-in - If they want to increase their payout amount or governance weight, they must stake more $FAIR3.

New users are attracted - seeing real compensation cases from foundations, they are more willing to buy Fair3 to qualify for insurance.

Market capitalization and ability resonance - Fair3 price increases, and the foundation has a stronger payout ability, further attracting more users.

Here's a typical closed-loop flywheel:

Insurance brings buying and pledge → Buying and pledge bring market capitalization → Market value brings stronger insurance capabilities → Stronger insurance capabilities lead to more buying orders.

What sets Fair3 apart from traditional projects: true anti-cyclical

The value of most crypto projects is supported by "narrative" or "application scenarios", and once the popularity subsides, they will face selling pressure.

Fair3 is different in that it gives holders a realistic and long-term reason to hold:

Even if there is no skyrocketing market, staking Fair3 is still valuable because it is the "market insurance policy" for users;

The more chaotic the market, the higher the insurance value, which is contrary to the logic that most coins shrink in a bear market.

Therefore, Fair3 is more of an "anti-cyclical token".

Potential impact: Fair3's long-term Holder logic

This means that Fair3 has the potential to shape a new Holder structure:

Short-term speculators will leave, but those who really stay will be those who use Fair3 as an insurance and governance tool.

Institutions and large investors may prefer long-term allocation because they need a bottom-up mechanism most in market volatility.

Retail investors will naturally form positions because of the intuitive logic of "buy Fair3 = buy insurance".

When a token's buying motivation changes from "gambling price" to "hedging risk", its holder structure will be healthier and longer-term.

For project parties: the introduction of a fair margin mechanism

In addition to users, the project team is also included in the flywheel.

The "fair margin mechanism" launched by the foundation allows projects to actively purchase and stake Fair3 as a promise that they will not rug. If the project experiences a future Rug or a significant drop in tokens, this margin will be distributed to all users who hold the corresponding tokens. This is essentially the project itself laying the insurance pool to prove its confidence in the project, and the Fair3 Foundation's mechanism is fair and safeguarded.

For the project, this is an open credit endorsement;

For users, projects that purchase fair margins are more secure and confident;

For Fair3, this means that in addition to users' buying and staking, the project team will also become a greater buying force, further accelerating the flywheel effect.

Conclusion: The evolution of value from insurance to flywheel

Fair3 represents not only a "personal risk protection tool" but also an institutional governance product that can be jointly referenced by platforms, exchanges, and project parties.

Wang Xin (former founder of Kuaibo) of the Fair3 CTO team said in an interview:

"Fair3 is not a project that plays a short-term game, it wants to solve the long-term lack of 'public goods structure' in the currency circle, which takes time to build and real events to verify its value."

Similarly, Ann Ann, founder of Unicorn Verse and investor of Fair3, also pointed out:

"At present, project parties and platforms are trying to bind users with incentives, but few people build a structural trust flywheel from the perspective of 'insurance mechanism'. Fair3 has shown us this possibility."

The Fair3 Foundation mechanism demonstrates a new possibility:

It has changed "fairness" from an idealistic slogan to a compensation guarantee that users can see and touch;

It turns "buying tokens" from speculation into a long-term logic of buying insurance and participating in governance.

The greatest value of this mechanism is not only to allow victims to receive compensation, but also to gradually accumulate a community of long-term holders through the flywheel effect.

In an environment full of uncertainty in the currency circle, this may be the scarcity "certainty".

This article is from a contribution and does not represent the views of BlockBeats.

About YZY (YZY)

Latest news about YZY (YZY)

Crypto Markets Today: BTC's Gain Lacks Derivative Traders' Support; YZY Leads to Losses

While the CoinDesk 20 Index of largest tokens has gained less than 1% in the past 24 hours, the CoinDesk 80 Index has rallied 4%.

Aug 28, 2025|CoinDesk

YZY Hype Machine Leaves Traders Nursing Millions in Losses on Ye-Linked Token

More than 51,800 addresses lost $1-$1,000, 5,269 are down $1,000-$10,000 and 1,025 shed $10,000-$100,000, Bubblemaps said.

Aug 28, 2025|CoinDesk

Kanye West’s Instagram hacked and now follows fake YZY coin account

Hackers took over the Instagram account of Kanye West, who now calls himself Ye Ye,...

Aug 27, 2025|Crypto Briefing

Learn more about YZY (YZY)

YZY Token Traders: Shocking Insights Into Losses, Insider Activity, and Lessons Learned

Understanding the YZY Token Launch and Its Price Volatility The YZY token, launched on the Solana blockchain and associated with Kanye West, captured widespread attention due to its extreme price vola

Aug 29, 2025|OKX

YZY Price: Unveiling the Volatility, Insider Activity, and Tokenomics Behind the Hype

Understanding the YZY Token Launch and Price Volatility The YZY token, associated with Kanye West and the Yeezy brand, has captured significant attention due to its dramatic price movements. Upon its

Aug 29, 2025|OKX

YZY Token Addresses: Unveiling the Controversy Behind Kanye West's Cryptocurrency Launch

Introduction to YZY Token Addresses and the Controversy The YZY token, launched on August 21, 2025, made waves in the cryptocurrency world. Backed by Kanye West and initially hosted on the Solana bloc

Aug 28, 2025|OKX

YZY Celebrity Token: Lessons from Its Rise and Fall You Can’t Ignore

Introduction to the YZY Celebrity Token Phenomenon The cryptocurrency market has witnessed numerous celebrity-backed tokens, but few have made as dramatic an entrance as the YZY celebrity token . Laun

Aug 27, 2025|OKX

YZY FAQ

What is cryptocurrency?

Cryptocurrencies, such as YZY, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as YZY have been created as well.

Can I buy YZY on OKX?

No, currently YZY is unavailable on OKX. To stay updated on when YZY becomes available, sign up for notifications or follow us on social media. We’ll announce new cryptocurrency additions as soon as they’re listed.

Why does the price of YZY fluctuate?

The price of YZY fluctuates due to the global supply and demand dynamics typical of cryptocurrencies. Its short-term volatility can be attributed to significant shifts in these market forces.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

Socials