1/ Gauntlet vaults functioned as expected in response to the events of the past week. Our vaults had no exposure to xUSD, and our curation methodology ensured we were prepared for this type of market volatility.

We are grateful to capital suppliers who voted with their capital and continue to trust Gauntlet vaults.

2/ We measure the success of our 75+ vaults with $2B+ TVL by how they respond to these kinds of stress events. Here's how our vaults responded:

• Overall curator TVL fell ~21% between 10/30 and 11/5, whereas Gauntlet TVL dipped ~11% over the same timeframe

• No losses experienced in Gauntlet-curated vaults

• No exposure to xUSD, as it did not meet our due diligence requirements

• No exposure to the Balancer exploit

3/ How we approach vault curation on protocols like @MorphoLabs

Gauntlet vaults are specifically designed to handle this type of crypto market volatility. Our risk management and curation framework balances yield generation and risk mitigation for events like these.

• Collateral due diligence: we only add markets to our vaults where the collateral asset has passed our robust due diligence process. xUSD did not.

• Active monitoring: our curation systems, informed by years of managing risk for the largest DeFi protocols, continuously monitor prices, liquidity, and market health, ensuring that we respond quickly to market changes.

• Risk-off automation: we implement risk-off actions through automated rebalancing and preemptive reallocations when simulated price and liquidity shocks indicate potential insolvent debt.

4/ Systems built on 7+ years of risk management experience

We’ve managed risk in DeFi since 2018, implementing risk parameter updates, assessing collateral selection, and developing governance frameworks for the largest protocols in DeFi. Our risk models have evolved over the years to ingest vast datasets that inform our vault allocations.

The models we employ are battle-tested across cycles.

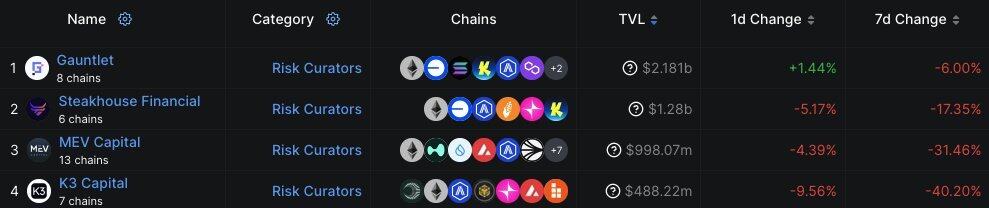

6/ Explore more data about risk curators:

8.11K

67

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.